How Mortgages Are Affected in Disaster-Prone Areas

Anyone who's ever lived in a region where natural disasters are prevalent knows all about the physical effect they can have on property, be it hurricanes, flooding, earthquakes, or any other destructive force of nature. What many people don't realize, however, is that disaster-prone areas often see increased housing costs, as well — and it can even impact mortgage rates. From higher insurance to damages and repairs to increased property taxes, there are several factors that can affect your mortgage rate.

Shopping for a new home requires a lot of research and thorough understanding of the housing market in your area. You have to examine the individual prices of homes as well as how those values have changed over time. In particularly weather-volatile areas, you'll want to take note of trends following major disasters: how often they occur, what kinds of property damage they cause, and their overall effect on home values in the area. Be specific as much as possible. For instance, does one neighborhood see more flood risk than others? Are older homes at any kind of increased risk because of outdated materials or design? Did homes with certain modifications fare better against extreme conditions? Keeping these kinds of questions in mind will help you shop smarter when it comes to both quality and price of local homes.

Further, it's important to consider the major additional expenses of homeownership like property tax and insurance. Taxes in disaster-prone areas sometimes increase following a major event, so find out how city and state taxes have fluctuated over the last 10-20 years. When it comes to insurance, rates can rise as a direct result of a natural disaster, driving up monthly costs at a time when many families will already be facing major home repairs. Also, many people don't realize that flood insurance is not included in most homeowner insurance policies, but must be purchased separately — and carefully.

It's important to keep these potentially fluctuating costs in mind. Even if they're currently sitting at an expected rate, it's impossible to say what the future will bring. For instance, if your property taxes are at an all-time low when you buy, it isn't necessarily the perfect opportunity to buy a more expensive house at a higher mortgage rate. If a major natural disaster were to strike your neighborhood six years down the road, you'll likely see insurance and property tax rates spike. The higher mortgage payment that was manageable the first six years could really come back to bite you, especially if your home incurs value-decreasing damage.

When it comes to your mortgage rate, there are a few considerations to keep in mind. First, if the cost of living (including handling the effects of natural disasters) tends to be high in your area, mortgage rates will already be somewhat steep. Not only are lenders likely to be cautious about investing in a home that's subject to dangerous conditions and damage, it's also safe to assume they'll take advantage of the current market. Simply put, if insurance and taxes are usually on the more expensive side, lenders may see the opportunity to keep their own rates high since homebuyers will already be expecting to pay more.

Next, you should consider the potential damage your home could face. You might see a fantastic deal on a large home, but if it's in the flooding zone of a coastal region then it's a major liability for both you and a lender. (And don't forget: flood insurance is an extra premium to pay!) If your home is seriously damaged in a flood, it could decrease the value even after repairs are made. In addition to the financial burden of repairs and preventative modifications, you'll be paying the same mortgage rate on a house that's now worth less money. Additionally, if other homes in the area fall in value, your home will have an even more difficult time getting its value back up to the original purchase price.

For example, suppose you purchase a house in southern California for $200,000 and have a monthly mortgage payment of $1,000. Ten years into the future, you've been making your payments and have built solid equity in your home. An earthquake strikes, causing extensive damage to your own home and many in your neighborhood. Insurance will probably help cover some but not all repairs, and you'll likely see your rates go up. Property taxes may also rise, depending on how many homes and businesses were affected and the severity of the damage.

Your mortgage rate won't automatically increase in this kind of a situation. However, if your home has suffered such severe damage that it's now only worth $150,000, you're already taking a loss by paying the same $1,000 a month (which was based on a home value of $200,000). Essentially, you'll be on-track to pay much more for the house than it's actually worth. When the time comes to sell, you'll either have invested significant amounts of money to boost the value back up to where it was, or you'll have to take a loss and sell it for less than you bought it for.

Additionally, if the value of other property in your area has gone down, it can make selling your home even more difficult. Say that following the earthquake, you realized it would be less costly to take the loss of selling your home at $150,000 rather than making all the necessary repairs (while paying increased costs in taxes, insurance, etc). If others in your area are doing the same, but their houses are selling for closer to $100,000, you're going to have a lot of trouble selling your home for $150,000. It can cause a troubling dilemma for homeowners who are already facing extensive home damage: sell the house at a major loss, or continue investing a great deal of money into it and hope that in time, the value and market recover. In the meantime, you'll be paying expensive home repair costs (and/or modifications to prevent future damage) and steeper insurance premiums and potentially higher taxes and a mortgage that reflects a higher value than the house is currently worth.

You should also keep in mind that if you do decide to sell following a natural disaster, you might have trouble when it comes to purchasing a new home. Even if a lender can see that you are in the process of selling your old property, they may be hesitant to grant you a new loan until all is resolved. Even if the house sells quickly, taking a loss on it will hurt your equity and thus your future borrowing abilities. You might end up facing a less-than-ideal mortgage rate on a new home — assuming you're able to get one at all — and ultimately not be much better off financially than you would be in your damaged home.

This isn't to say that you can never make a wise investment on a home in a disaster-prone area, but instead that there are many risks to consider. Ideally, you'll never see any destructive weather or find your house in shambles after a natural disaster, but if you live somewhere that commonly endures these types of events, you can't discount their possibility of happening. The more you know about the risks ahead of time, the more informed a decision you can make when the time comes to buy.

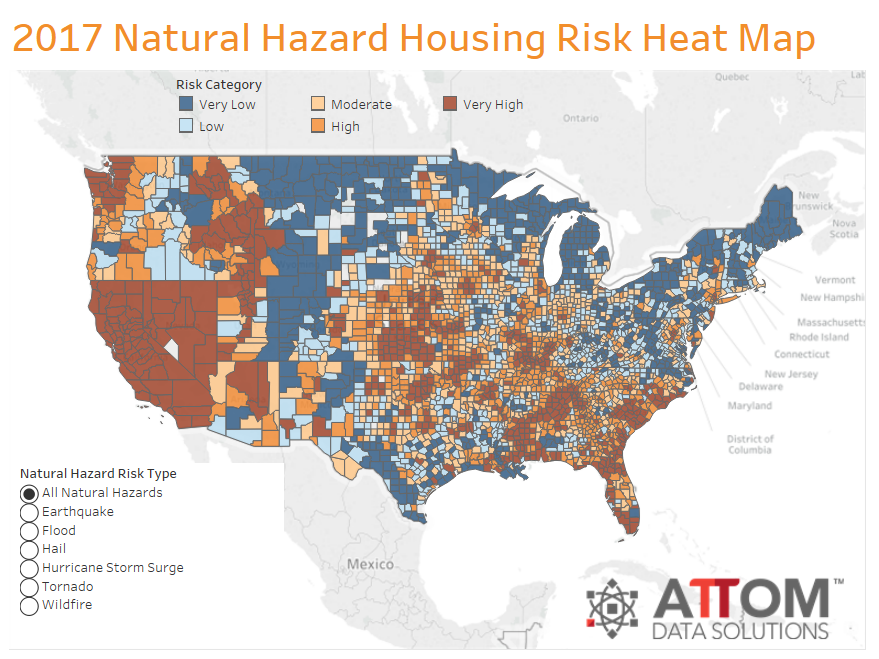

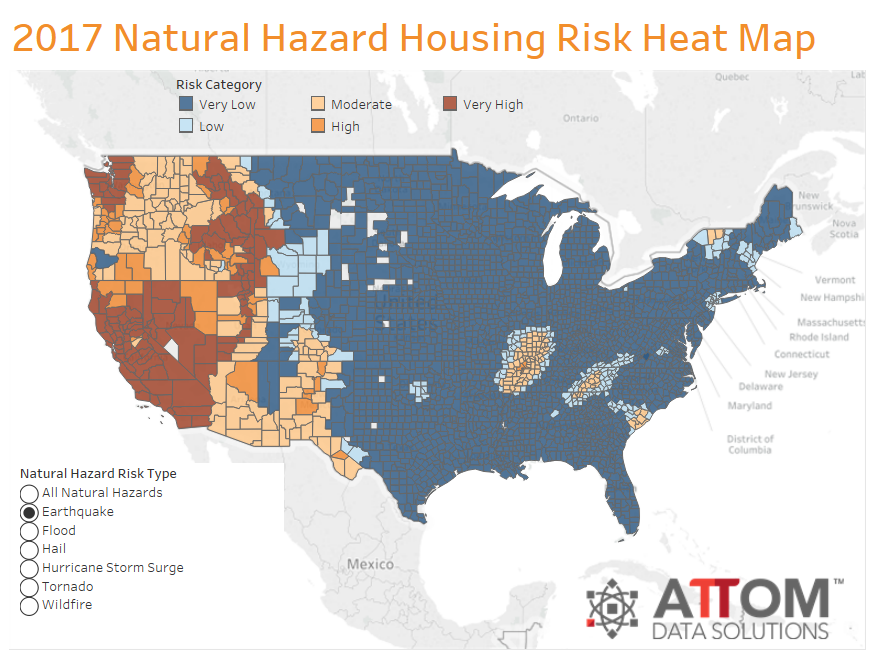

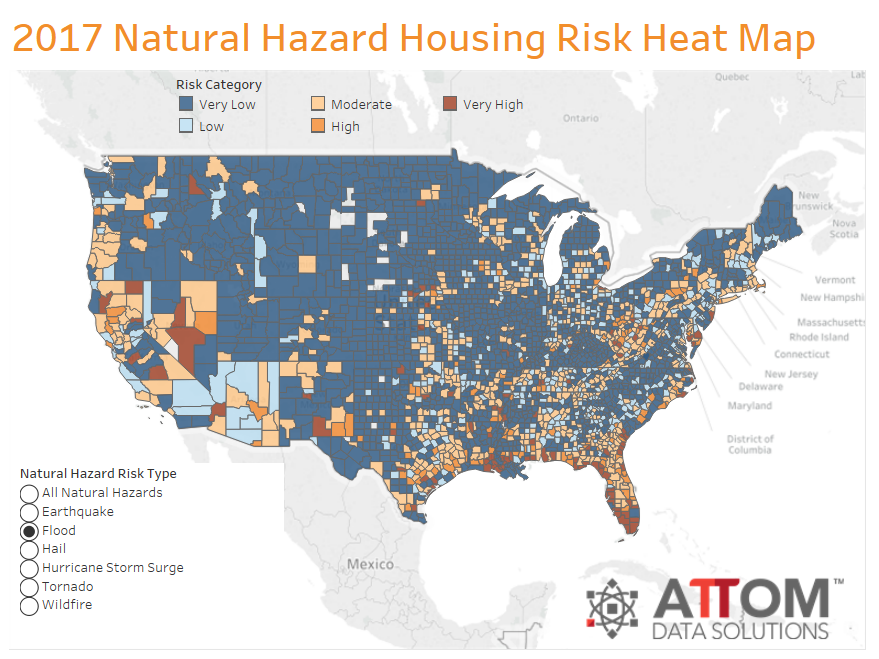

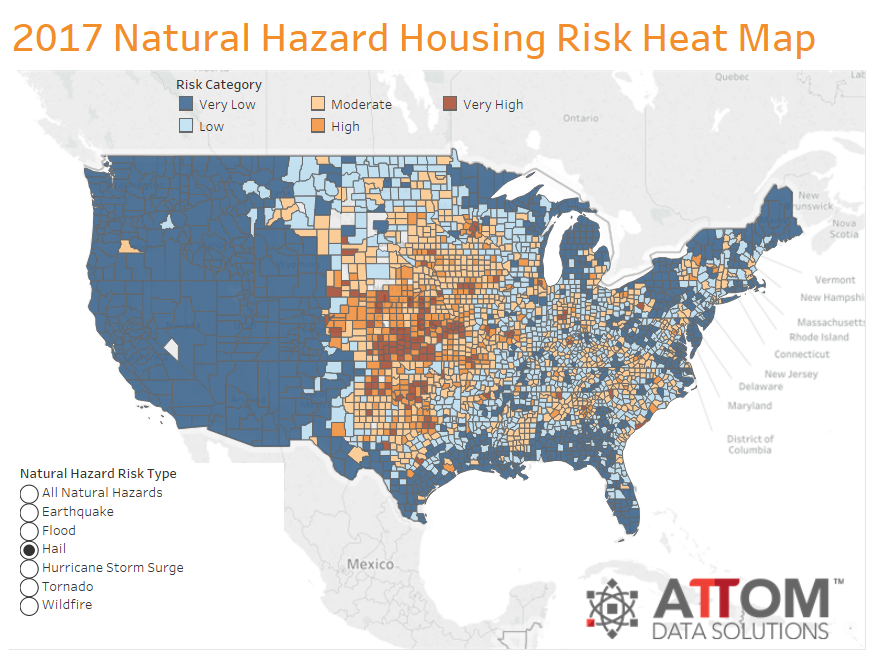

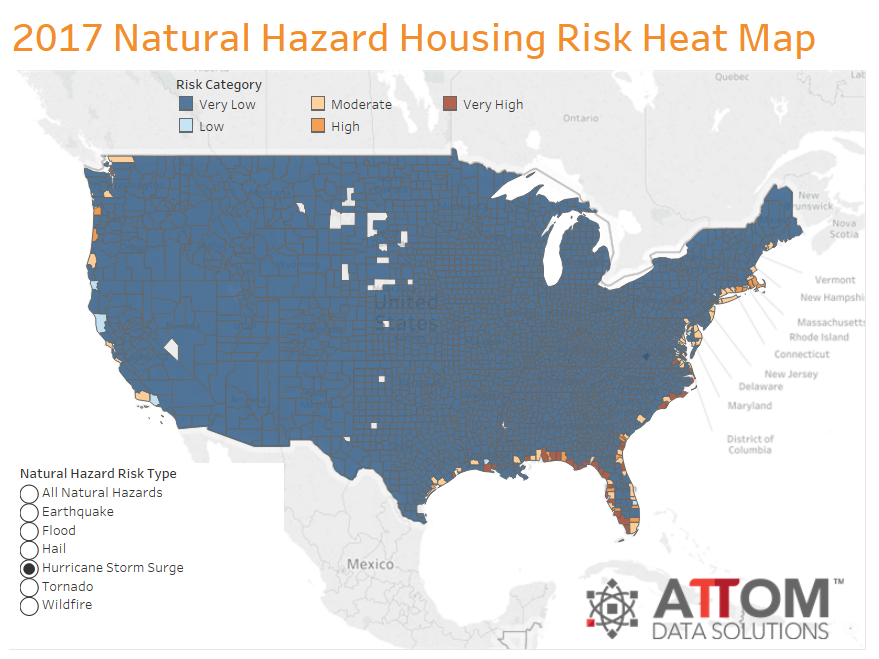

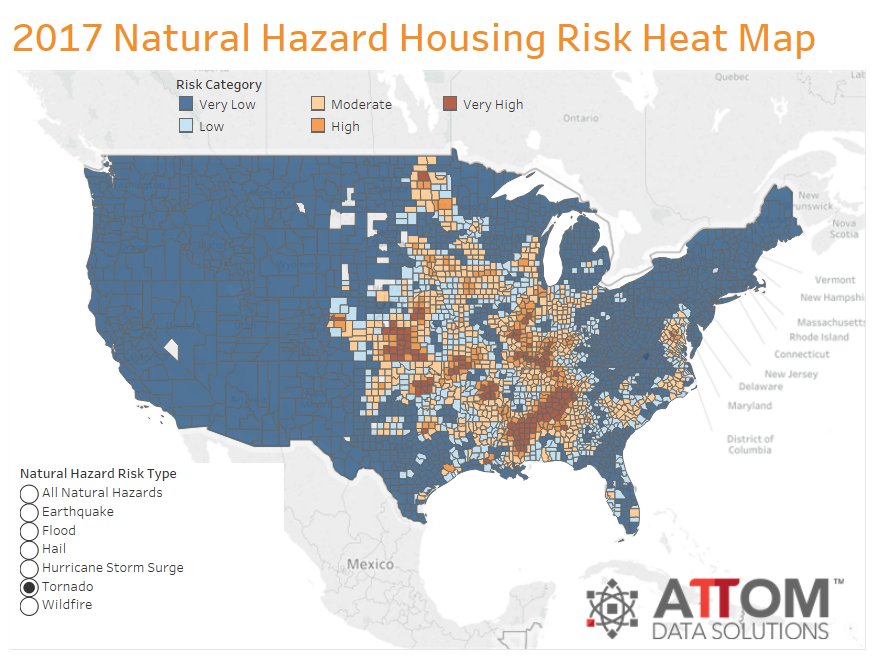

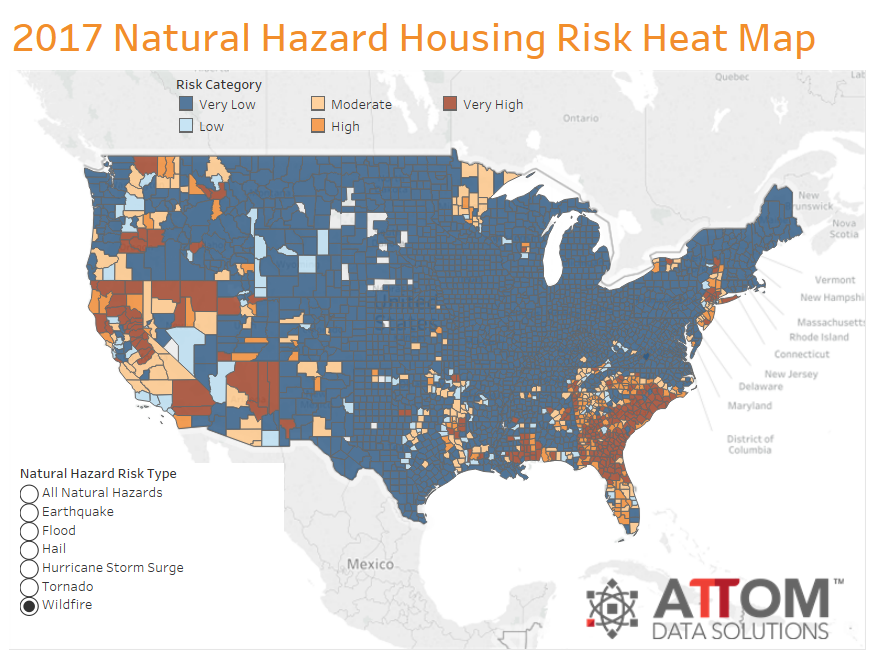

Here are graphics of the different types of risks home owners face.

All Natural Disasters Combined

Earthquake Risk

Flooding Risk

Read our flooding protection guide for more information.

Hail Risk

Hurricane Risk of Storm Surge

Tornado Risk

Read our tornado protection guide for more information.

Wildfire Risk

Read our wildfire protection guide for more information.

Summary

If you're shopping for a new home in a disaster-prone area, do your homework to find out exactly what your risks are and how to avoid damage. Talk to a real estate agent about which neighborhoods see the least amount of damage from natural disasters and the kinds of updates and modifications that can reduce a home's risk of damage. Shop around for a fair mortgage rate, and make sure you understand all the terms and conditions of each option. Don't feel pressured to sign anything before you're ready and absolutely confident. When it comes to buying a new home and committing to a lifelong mortgage, it's absolutely vital to know you're signing up for the right opportunity.