Getting a Mortgage in a Wildfire Risk Area

You won't necessarily find it harder to get a mortgage on a home in an area that's vulnerable to wildfire, but other home-ownership costs might be a bit more expensive.

Where are Wildfires a Risk?

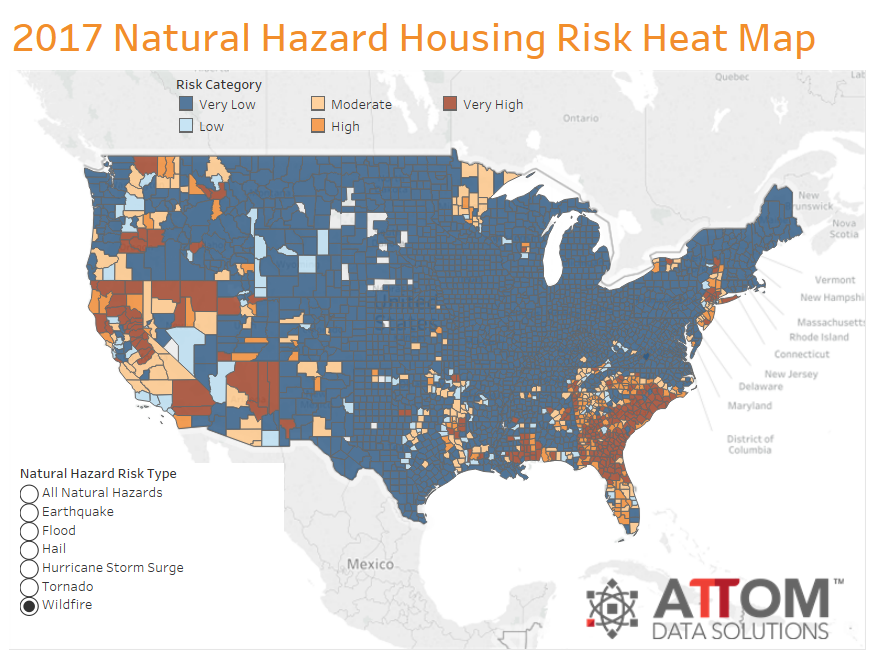

Of the ten most damaging wildfires in US history, eight have occurred in California. However, while the greatest risk is definitely in the south-west, and in California in particular, almost all states have some regions where wildfires are a risk.

According to a report by the USDA, nearly one-third of US homes are located in areas called "wild-land urban interfaces," or, areas where houses are built amongst the natural landscape of trees and shrubs. It's these areas that are most at risk in hot, dry weather, and the risk is present even in partly urban areas—a home doesn't have to be situated in the middle of a forest to be vulnerable. Due to a combination of location and climate, an estimated 4.5 million US homes are highly vulnerable to wildfires.

It should be noted that risk level isn't static; it can change for a variety of reasons that aren't limited to seasonal factors. It's possible that the level of risk may increase across the country due to factors relating to climate change, for example, and in the coming decades, areas where the level of risk is currently low or moderate may become more vulnerable. Risk level can also change as a result of rural and urban development, when land is cleared or partially cleared to provide room for new construction.

Does Wildfire Risk Affect Mortgage Eligibility or Cost?

Buying a home in an area that's vulnerable to wildfires doesn't directly affect whether or not you can get a mortgage, or how much a mortgage will cost. After all, if it did, nobody would build, buy, or sell homes in at-risk areas. There are, however, some instances where wildfire risk might indirectly have a small effect on your mortgage.

One such instance is the cost of your homeowner's insurance. Getting a mortgage to buy a home typically involves using the home you're buying as collateral for the loan. Since the mortgage lender has a hefty financial stake in the property—up to 95% depending on the size of the down-payment—they require that the buyer purchases homeowner's insurance to protect against damage to the property. In most cases a home-buyer is required to pay several advance insurance payments into the home's escrow account at the time of closing.

While some types of damage—like earthquake and flood damage, for example—aren't included in a standard homeowner's insurance policy, fire damage, including wildfire damage, is included. A standard policy is therefore all a homeowner needs to provide their property with coverage for wildfires.

The main difference for people in vulnerable areas is that insurance is likely to be more expensive, due to the increased risk of fire. However, homeowners can reduce the risk of serious property damage—and reduce their insurance costs—by taking measures to protect their homes from fire damage, or purchasing a property that is less vulnerable to damage. For example, homes that are made from non-flammable materials like stone and brick are much less vulnerable to complete destruction than homes made from wood. As a result, such homes typically cost less to insure.

Where Are Wildfires Most Likely to Occur?

What Happens to Your Mortgage if You're Affected by a Wildfire?

If your home is damaged by a wildfire, you have several options for dealing with the aftermath. When the damage is mild to moderate, most homeowners choose to use the insurance payout to repair the property. However, in cases where a home is completely destroyed by fire, some people choose to use insurance money to pay off the outstanding mortgage balance, rather than rebuilding.

Unless a mortgage contract explicitly states otherwise, homeowners have the freedom to choose between the two options. Some mortgage lenders (or mortgage servicers, if the mortgage has been sold) pressure homeowners to pay the mortgage, rather than rebuild, but in most cases homeowners have the option of rebuilding if they choose to, and can't legally be forced to do otherwise.

Summary

- Most states have regions where there is a risk of wildfire, but some states, like California, Texas, and Colorado, have regions where there is a much greater risk

- Risks change due to seasonal factors, as well as changes in the rural and urban environment, and may also fluctuate in the long term as a result of climate change

- Wildfire risk doesn't reduce mortgage eligibility or increase the costs of a mortgage, but it can increase other costs of home-ownership, such as insurance

- Fire damage is covered by standard homeowner's insurance

- Since advance insurance payments are required at closing, home-buyers purchasing a home in an at-risk area will need to come up with a little more money to cover the higher insurance costs

- When an insured home is destroyed by fire, the owner can use the insurance money to rebuild, or to repay the mortgage, depending on the terms of their mortgage contract